News

TI Canada Makes Submission to OECD Review of Canada's Implementation of Anti-Bribery Convention

On Friday, March 31, TI Canada made a submission to the Organization of Economic Cooperation and Development’s (OECD) open call for contributions for Canada’s fourth phase of monitoring the implementation of the OECD Anti-Bribery Convention.

Canada’s Federal Government puts forward a suite of measures to tackle corruption and financial crime

Budget 2023 introduces a number of reforms and elaborates on ongoing initiatives to strengthen Canada’s anti-money laundering (AML) regime. These measures are welcomed by a coalition of civil society organizations – Publish What You Pay Canada, Transparency International Canada, and Canadians For Tax Fairness.

Une victoire importante pour la lutte contre le blanchiment d’argent au Canada

Dans un geste décisif contre l’argent sale, le gouvernement du Canada dépose un projet de loi pour la création d’un registre public de propriété effective des societés.

Canada deals a massive blow to money launderers with strong legislation for a publicly accessible corporate beneficial ownership registry.

Canada tables legislation for a publicly accessible corporate beneficial ownership registry which includes scalability for provinces and territories, data verification and validation.

Indice de perception de la corruption 2022 : le Canada stagne au classement annuel de Transparency International

Le score du Canada dans l'Indice de perception de la corruption (IPC) 2022 de Transparency International stagne avec une note de 74 sur 100. Mais si le Canada est resté dans le peloton de tête des pays les moins corrompus, son classement est cependant passé de la 13e à la 14e place, dépassé par l'Australie et l'Irlande.

CPI 2022: Canada Fails to Improve on Transparency International Annual Ranking

Canada’s score on Transparency International’s 2022 Corruption Perceptions Index remained stagnant with a score of 74 out of 100. While Canada remained in the top tier of least corrupt countries, its ranking dropped to 14th place from 13 after being overtaken by Australia and Ireland.

In This Window of Political Will To Act on Corruption, Wealthy Democracies Must Address Their Own Roles

There is a moment of increasing political will by wealthy democratic nations address global corruption, especially in the wake of Russia’s invasion of Ukraine. With potential leadership from the US, and emerging interest from countries like Canada and the Netherlands, it is critical that this political will for anti-corruption focus domestically as well as internationally.

David Hutton receives 2nd Canadian Integrity Award

At the 2022 Toronto Day of Dialogue on November 17, TI Canada recognized Mr. David Hutton for the 2nd Canadian Integrity Award. Mr. Hutton is Senior Fellow at the Centre for Free Expression at Toronto Metropolitan University.

TI Canada also recognized as an honourable mention, the Radio-Canada investigative journalist program Enquête. Representing Enquête at the Day of Dialogue were managing editor, Luc Tremblay and host, Marie-Maude Denis.

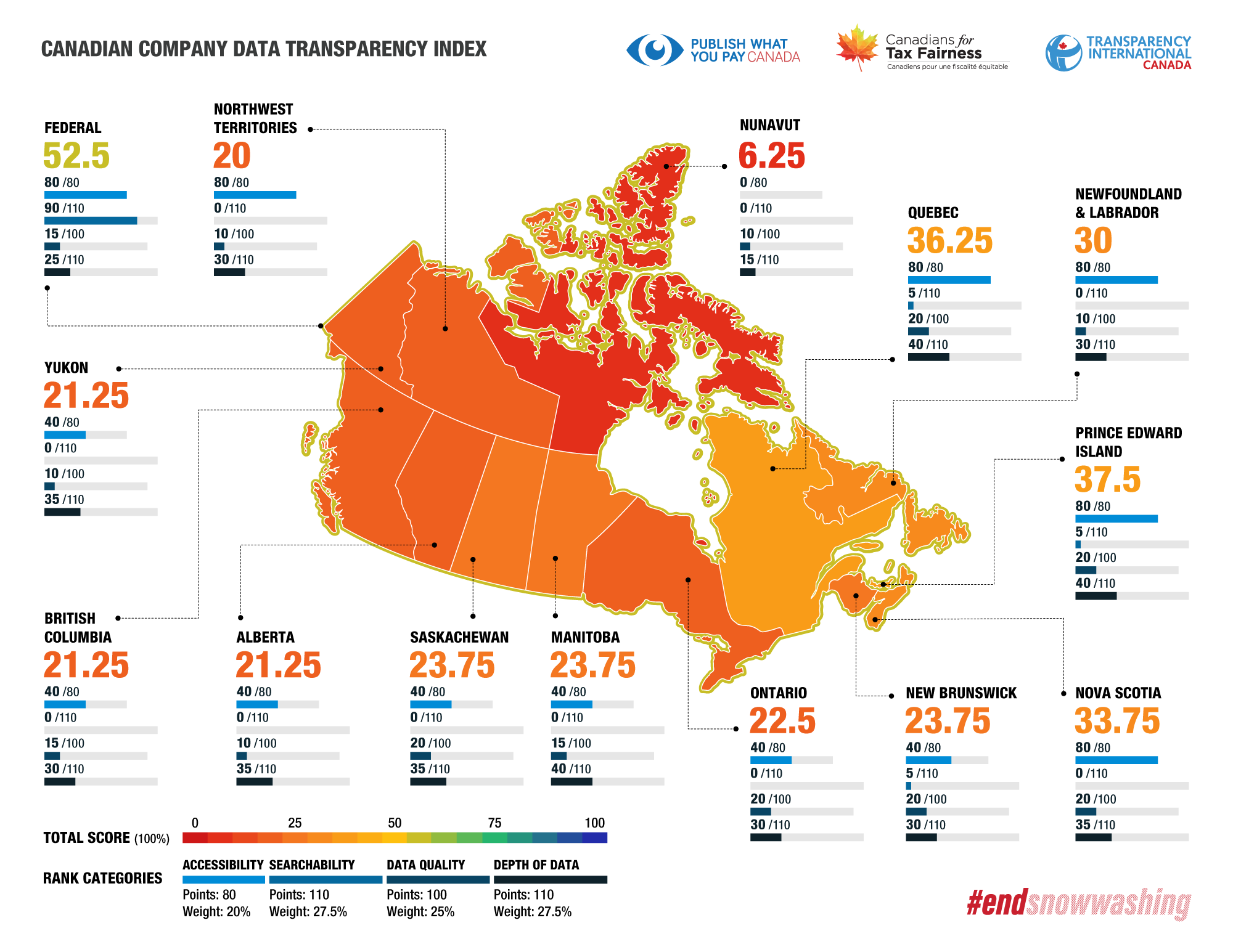

New Report - Provinces need to step up and work with feds to resolve Canada’s opaque patchwork of corporate data

As the federal government prepares to launch a public beneficial ownership registry in 2023, the current state of corporate data across all 14 Canadian jurisdictions is an opaque patchwork – leaving Canada vulnerable to money laundering and other financial crimes. Provinces and territories are the weakest link.

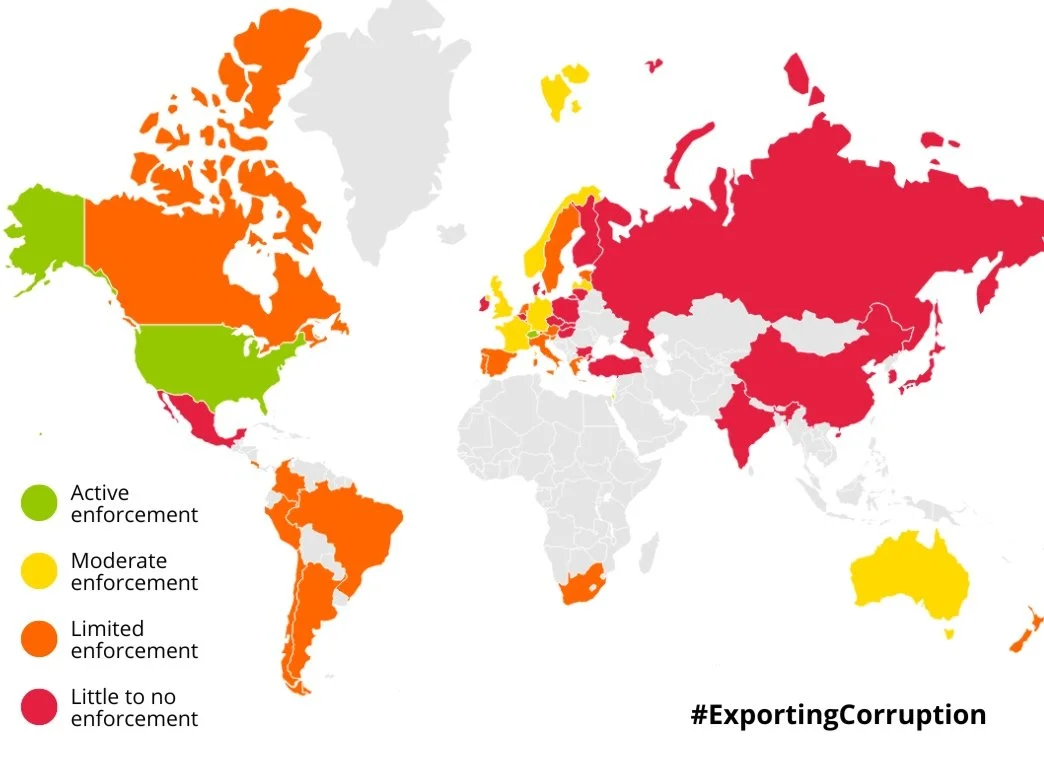

Le Canada ne fait toujours qu'une application “limitée” de sa Loi sur la corruption d’agents publics étrangers

Selon le dernier rapport de Transparency International, le Canada n'applique que de manière limitée la Loi sur la corruption d'agents publics étrangers (LCAPE).

Canada Still Only Carries Out ‘Limited Enforcement’ of Foreign Bribery Law

Canada only carries out ‘limited enforcement’ of the Corruption of Foreign Public Officials Act (CFPOA) according to the latest biannual Transparency International Report.

Enhancing Trust Transparency: Transparency International’s Revisions to Recommendation 25

The Financial Action Task Force (FATF), the global anti-money laundering and anti-terrorist financing governing body, recently held public consultations concerning its guidance on trusts. In Recommendation 25 (R25) of the FATF guidelines for members, the FATF calls upon countries to “ensure that there is adequate, accurate and timely information on express trusts, including information on the settlor, trustee and beneficiaries that can be obtained or accessed in a timely fashion by competent authorities”.